Presented by Mary Queen Development Ltd

Presented by Mary Queen Development Ltd

Presented by Mary Queen Development Ltd

Invest in Land, Not Construction Risk

295-Unit Site Plan Approval | St. Marys, Ontario

The Opportunity

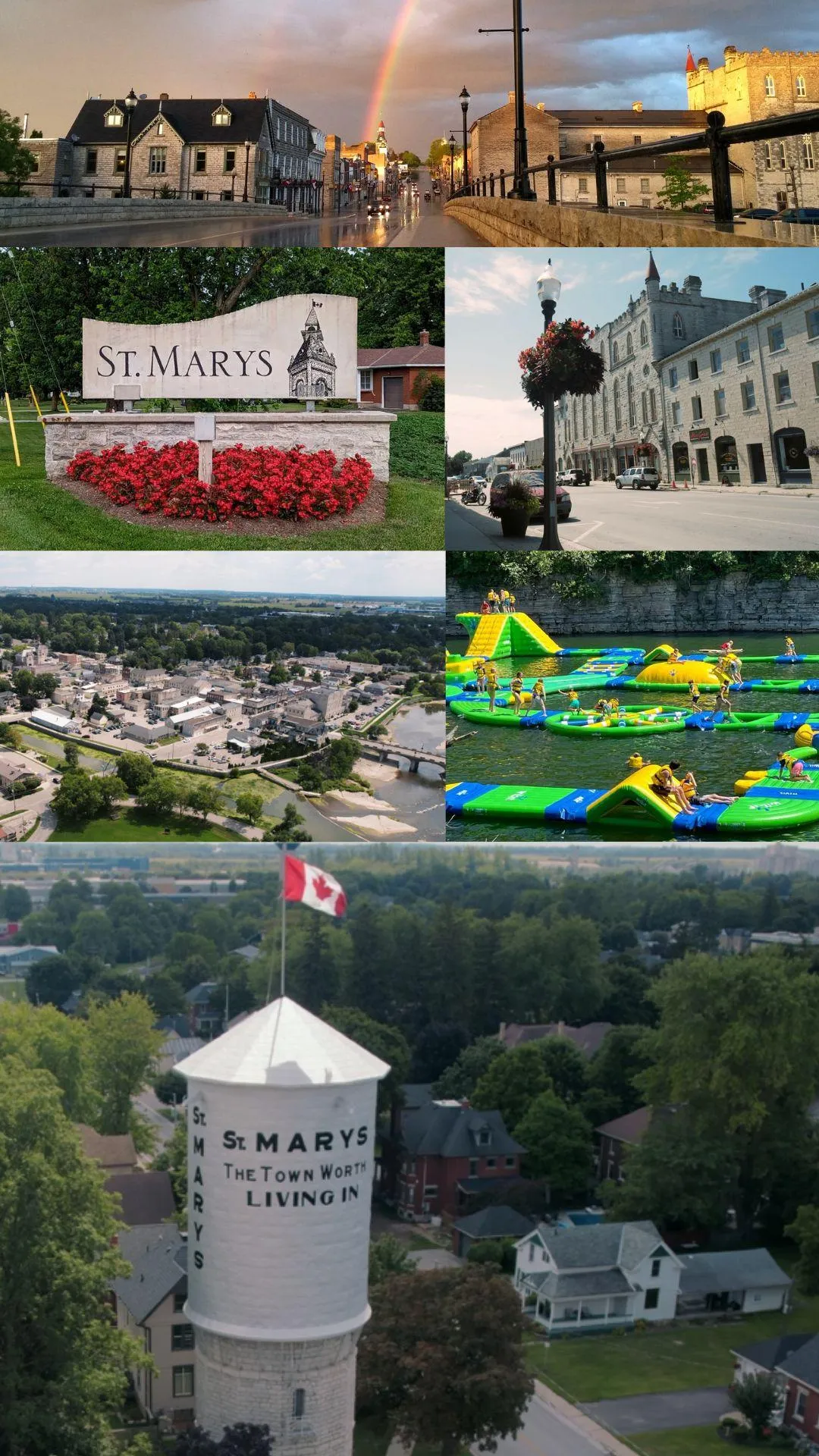

StoneHaven Meadows is a 23-acre site in the heritage town of St. Marys, Ontario, in one of Canada’s fastest-growing corridors near London, Stratford, Kitchener, and the 401.

This is an entitlement play — raw land to site plan approval for 295+ residential units, including detached homes, townhouses, and low-rise apartments.

You capture the value uplift of land transformation without taking on construction exposure.

Why This Deal Stands Out

50% Equity at Acquisition

Purchased for $5.5M, appraised at $11.1M. Value locked in from Day 1.

Targeted Returns

30%+ annual average, 1.9x multiple in 3 years, and a 10% annual preferred return at exit (bonus 2% for $250K+).

No Construction Risk

Investment stops at Site Plan Approval. No delays, no contractors, no overruns.

Fast-Track Approvals

Severed, zoned residential, services at the perimeter. Pre-consultation complete.

Builder-Ready Demand

Lot pricing set 25% below market, enabling homes priced from $500–550K.

Flexible Exit Options

Sell to multiple builders, phased exit, or refinance post-approvals.

Why This Deal Stands Out

50% Equity at Acquisition

Purchased for $5.5M, appraised at $11.1M. Value locked in from Day 1.

Targeted Returns

30%+ annual average, 1.9x multiple in 3 years, and a 10% annual preferred return at exit (bonus 2% for $250K+).

No Construction Risk

Investment stops at Site Plan Approval. No delays, no contractors, no overruns.

Fast-Track Approvals

Severed, zoned residential, services at the perimeter. Pre-consultation complete.

Builder-Ready Demand

Lot pricing set 25% below market, enabling homes priced from $500–550K.

Flexible Exit Options

Sell to multiple builders, phased exit, or refinance post-approvals.

Why St. Marys?

✔ Population projected to grow 50%+ by 2051

✔ Homeownership demand at record highs (costs up 62% since 2019)

✔ Average household income $124K, strong affordability base

✔ Municipal support for new housing

✔ Desirable location with schools, healthcare, grocery, and transit nearby

St. Marys offers the charm of small-town living with proximity to major urban centers and a stable, diverse job market.

Track Record You Can Trust

Investment Summary

Meet the Team of Professionals

Hisham Kufaishi

CEO

Hisham Kufaishi, CEO at Mary Queen Development Ltd has 15+ years of land acquisition to asset disposition experience. He has developed/sponsored 900+ residential units in Southern Ontario as a principal with ALKU and Collective Developments. Passionate about improving development capabilities in Ontario and as an Industrial Engineer and Lean Six Sigma expert he uses the “Clearing the Path to Land Value” strategy to reduce approval risk and timelines to improve investor value and returns.

Denise K. Evans

Strategy & Investor Relations

With 30+ years in real estate and infrastructure, Denise Evans is a trusted leader known for transparency and results. As a former Ontario Director of Building Development, she drove major projects and regulatory reforms. Now as Founder of Storied Properties, she owns or co-sponsors 200+ units across asset classes and helps others build wealth and legacy. Her expertise in risk management, due diligence, and financial strategy makes her a valued partner for equity investors.

Judith Wong

Business Operations & Project Management

With deep experience in condominium redevelopment and construction management, Judith Wong has overseen multimillion-dollar projects from concept to completion, growing revenues and guiding boards through complex design and budgeting decisions, blending financial discipline with design expertise. Her track record across leading developers including LAR Construction, H&R Developments, Monarch Construction, and Cresford Developments makes her a valuable partner for investors.

Brooke William Askin

Acquisition & Business Development

Brooke Askin brings 20+ years of leadership in real estate development in Southwestern Ontario - specializing in land banking, entitlement and servicing projects, and joint ventures. He has structured investment platforms for major residential and commercial projects to deliver strong investor return. His track record of securing municipal approvals and delivering projects ahead of schedule reflects his foresight and commitment to building communities that last.

Junaid Javaid

Asset Management

Junaid Javaid is known for his entrepreneurial drive. He has led acquisitions, asset management, and development at Collective Developments and JJ Real Estate Investments, while also founding LandWealth Academy to mentor aspiring investors. His experience spans construction management to navigating municipal approvals ensuring all aspects of land development are considered to ensure project success.

Testimonials

“Transparent, Thoughtful, and Reassuring”

"Our experience with Denise Evans has been really positive. From the beginning, she was straightforward and took the time to explain everything clearly. The investment opportunity she offered was well thought out and aligned with our goals. We especially appreciated the frequent updates, which kept us in the loop and gave us confidence that everything was moving in the right direction. We would definitely recommend Denise Evans to anyone looking for a trustworthy investment opportunity."

- R. BRUCE (Dec 19, 2024)

"Handled with Care and Clarity"

"It was a pleasure doing business with you. As a first-time investor in this type of project, I appreciated the regular updates and how the project was handled."

- SHIRLEY H. (Feb 26, 2025)

"Supportive from Start to Finish"

"Working with Denise was an outstanding experience. From the beginning to the end of the process, she was super communicative, helpful, and clear at every step. She explained the process in plain language, delivered exactly what was promised, and my return arrived on schedule. I felt confident and well-supported throughout."

- S. CHERNIAK (July 24, 2025)

Ready to Take the Next Step?

Book a Call with our Investor Relations team to review projections, structure, and timing.

Let’s discuss how StoneHaven Meadows can fit your portfolio.

"Building Wealth, Creating Attainable Homes, Shaping Futures."

Ready to Take the Next Step?

Book a Call with our Investor Relations team to review projections, structure, and timing.

Let’s discuss how StoneHaven Meadows can fit your portfolio.

"Building Wealth, Creating Attainable Homes, Shaping Futures."

Say Hi, Get in Touch

Disclaimer: This opportunity is for accredited investors only under Canadian securities laws. This is not a solicitation to purchase securities and is provided for informational purposes only. Targeted returns are not guaranteed, and all investments carry risk. Past performance does not indicate future results. Please review documents related to this offering for full details.